Build, Launch, and Comply — Faster

A modular core banking platform with fintech APIs and RegTech automation to help you move from idea to production safely, and at speed.

Core Banking

Real‑time ledger, products, payments, and reporting.

QR Acquiring

Helping clients minimize their tax liabilities and take.

Fintech

Onboarding, screening, KYC, compliance, and monitoring.

Regtech

Risk scoring, MRZ parsing, and liveness verification.

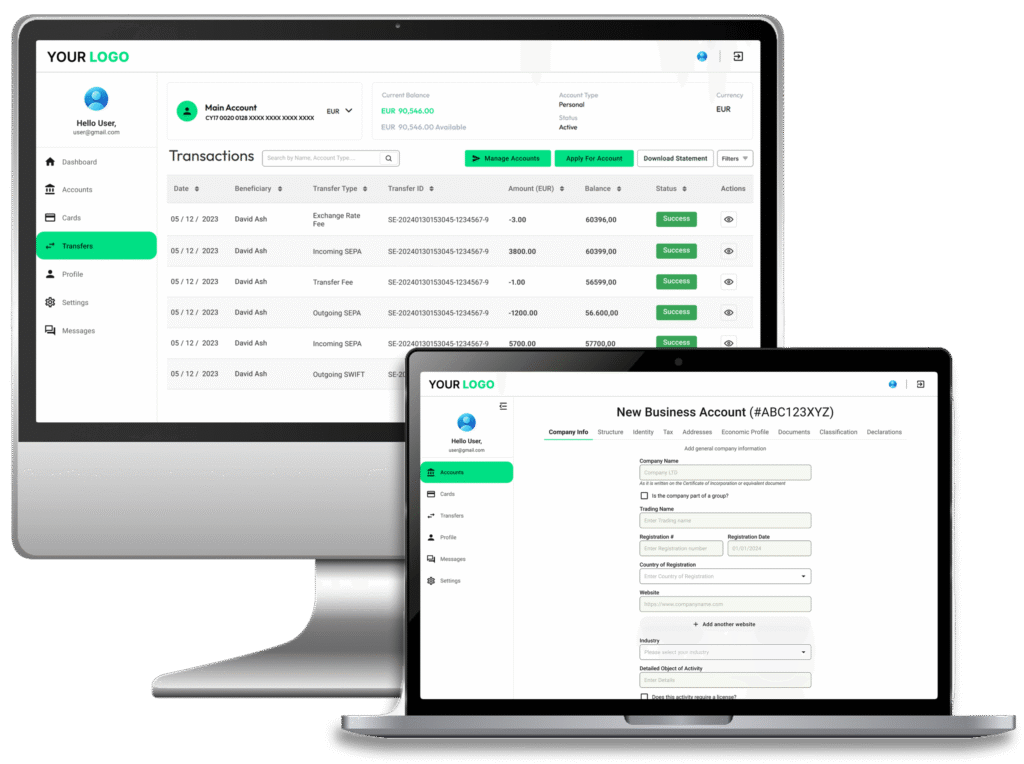

Customizable Fintech Solutions

At Modular Fintech, we offer a range of modular fintech solutions to meet the unique needs of your business. Whether you are an Electronic Money Institution, Payment Gateway, or other licensed electronic money handler, our customizable modules provide you with the flexibility and control you need to manage your customers’ finances with ease.

Flexible reports

Helping clients minimize their tax liabilities and take advantage of tax-efficient investment strategies.

Safe transactions

Core Banking Full or Modular

You can have a Core Banking platform fully integrated with RegTech or separate. The Integrated has many advantages in streamlining the onboarding compliance and the and transaction monitoring. Our Software contains these modules and more, all based on ISO 20022 Data Messaging Standard.

- Online Clients Boarding

- Mass Payments

- KYC & AML Screenings

- Reporting

- Transaction Rules

- Flexible Boarding Form

Personalized Solutions

You may decide tyo take the full ready-made solution of Core banking & AML fully incorporated or you may want the Core banking module if you have your own provider of RegTech – Compliance and KYC Screenings in Sanction lists, Adverse media and PEP verification. You may request just the software or the integration with your bank’s APIs.

- Full or Modular

- Flexible Transaction Rules

- Facilitated API Integrations

- Flexible Fee Structure

- Tech Support

- Flexible Boarding Form

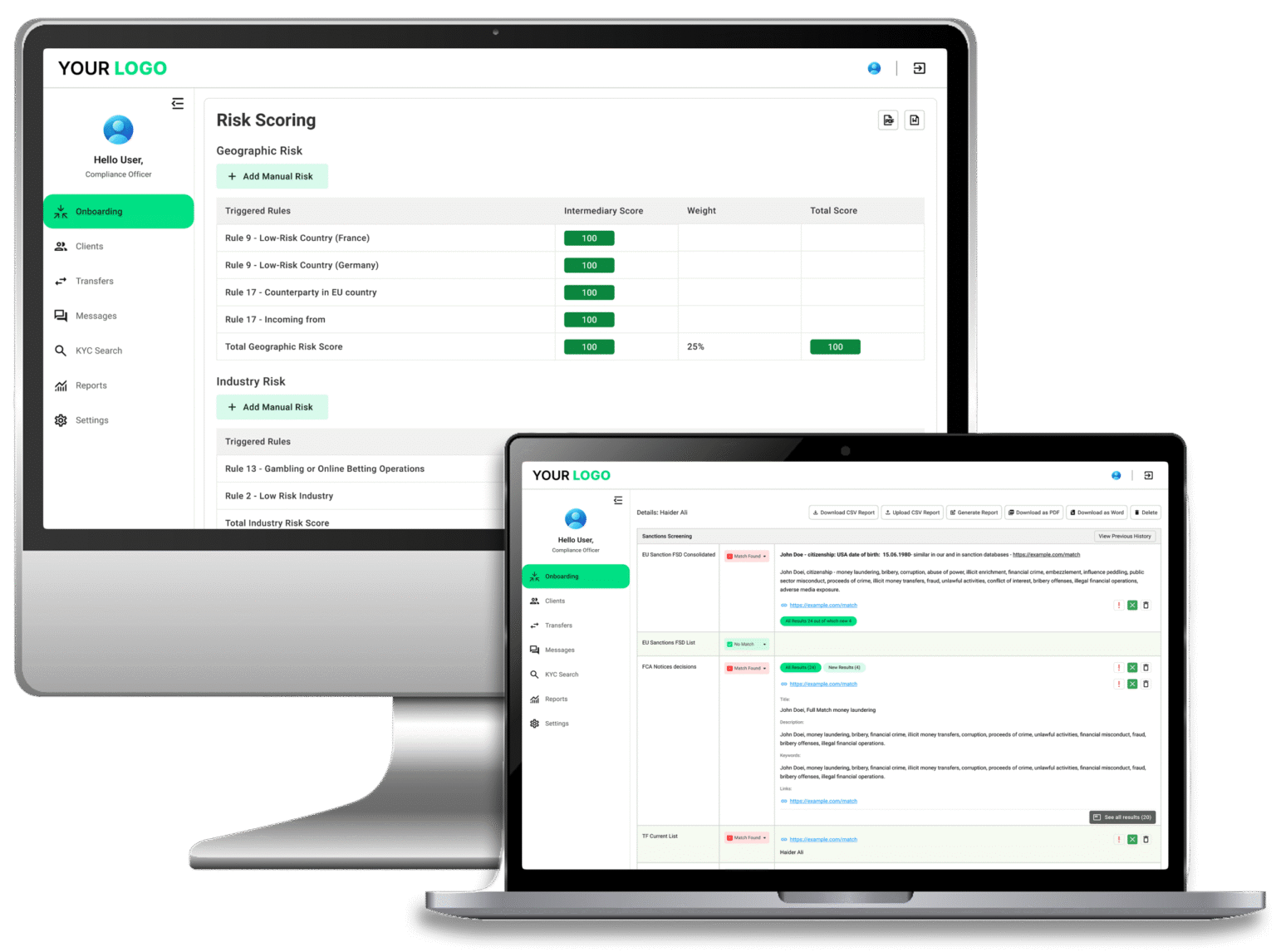

FinTech Integrated with RegTech or Separate

Our RegTech can be acquired separately, either through license or SAAS.

- Liveness & Passports check

- Sanctions Lists Screening

- Adverse media, PEP

- Customer Risk Scoring

- Transaction Risk Scoring

- OCR and KYC reminders

Features and benefits

Save time and improve productivity with a customizable compliance workflow, allowing you to automate repetitive tasks and focus on what matters most. Offer to your customers the best user experience with a banking software.

Modern Ledger

Double‑entry, event‑driven postings with idempotency and full audit trails.

Payments Ready

ISO 20022 support for SEPA rails, SWIFT mapping options, and reconciliation tools.

Onboarding Flows

Individuals and businesses, UBO mapping, and address verification.

Screening Engine

Sanctions, PEPs, and adverse media with fuzzy matching and evidence packs.

Risk & Monitoring

Rules‑based risk scoring for clients and transactions, plus real‑time alerts.

Developer‑First

OpenAPI specs, webhooks, SDKs, and a production‑like sandbox.

How It Works

At Modular Fintech, we offer a range of modular fintech solutions to meet the unique needs of your business. Whether you are an Electronic Money Institution, Payment Gateway, or other licensed electronic money handler, our customizable modules provide you with the flexibility and control you need to manage your customers’ finances with ease.

Assemble

the building blocks you need (ledger, onboarding, monitoring).

Integrate

via API and webhooks with your existing stack.

Operate

with configurable policies, auditability, and reporting.

Security & Compliance

Designed with encryption at rest and in transit, role‑based access controls, comprehensive audit logs, GDPR‑supporting features, and alignment with EU frameworks such as PSD2/PSR, AMLD6, and ISO 20022 message formats. (Your institution remains responsible for compliance and filings.)

Works with Kubernetes, PostgreSQL, OpenAPI, OpenTelemetry, cloud or on‑prem.